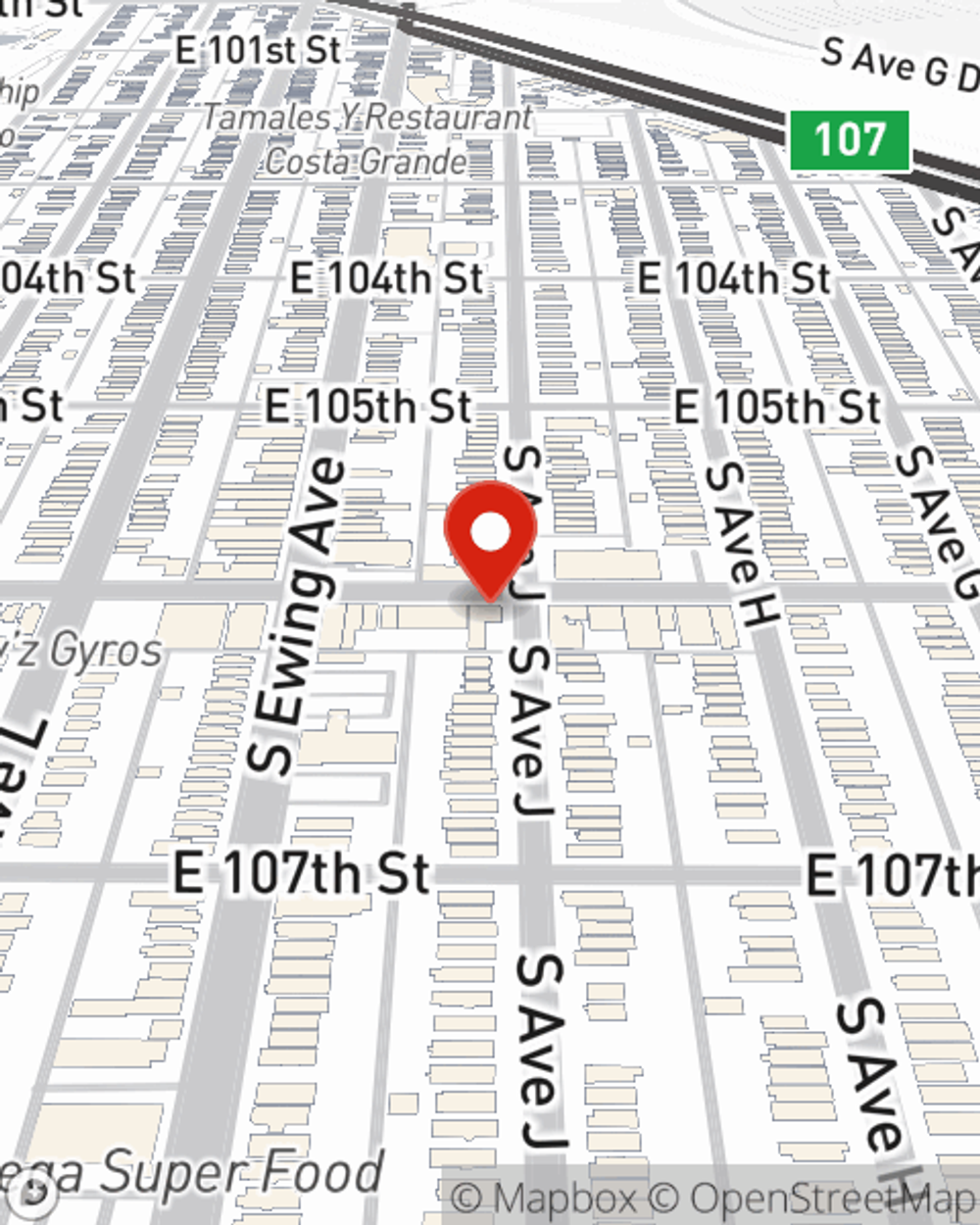

Condo Insurance in and around Chicago

Condo unitowners of Chicago, State Farm has you covered.

Condo insurance that helps you check all the boxes

Your Belongings Need Coverage—and So Does Your Condominium.

The life you cherish is rooted in the condo you call home. Your condo is where you catch your breath, slow down and chill out. It’s where you build a life with family and friends.

Condo unitowners of Chicago, State Farm has you covered.

Condo insurance that helps you check all the boxes

Why Condo Owners In Chicago Choose State Farm

We get it. That's why State Farm offers great Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Mike Johnson is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that provides what you need.

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Get in touch with Mike Johnson's office today to explore how you can benefit from Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Mike at (773) 221-4900 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Mike Johnson

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.